Planning for post-work life is important as we must take our sustenance and well- being into our own hands and make adequate preparations that enable us have a well-earned rest after a long period of active service. Contributing to a pension scheme while you’re working and earning is a critical way to guarantee that you can sustain a reasonable lifestyle after years in active employment.

THE NEW THREE TIER PENSION SCHEME

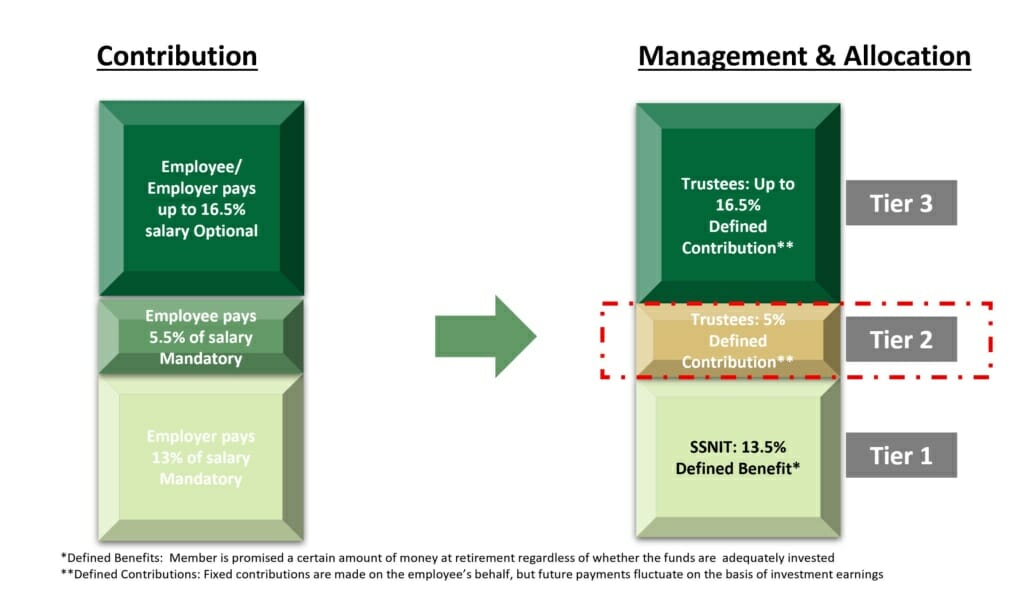

The Pension Act of 2008 (ACT 766) as amended introduced a new tier 2 and 3 pension scheme to complement the SSNIT pension scheme. The Tier 2 is a mandatory defined contribution scheme where employees contribute 5% of their monthly salary. Tier 3, on the other hand, is a voluntary scheme where employees and/or their employer contribute up to 16.5% of their monthly income towards the employee’s pension.

THE THREE TIER PENSION STRUCTURE

THE THREE TIER PENSION SCHEME – BENEFITS

| Features | Tier 2 | Tier 3 |

| Portability | All contributions and net returns on investments may be bequeathed as an inheritance. Can be moved from one Scheme to another (tax free) | All contributions and net returns on investments may be bequeathed as an inheritance. Can be moved from one Scheme to another (tax free) |

| Accessibility | Can be accessed at statutory retirement age of 60 | Tier 3 is accessible at any time |

| Segregation | Neither government nor employer has access to the funds | Neither government nor employer has access to the funds |

| Income Earned | Depends on the quality of investments made by Trustee | Depends on the quality of investments made by Trustee |

| Tax Advantage (Contributions) | Contributions made into your tier 2 are not subject to income tax | Contributions made into your tier 3 are not subject to income tax |

| Tax Advantage (Withdrawal) | Withdrawals from your tier 2 upon retirement are not taxable | Withdrawals from your tier 3 at any time after 10 years are not taxable |

| Retirement Benefit | Lump Sum | Lump Sum |

| Mortgage | May be used to secure your primary mortgage without any tax obligations | May be used to secure your primary mortgage without any tax obligations |

| Use As Security | Cannot be used as security for borrowings | Tier 3 assets may be used as security for borrowings |